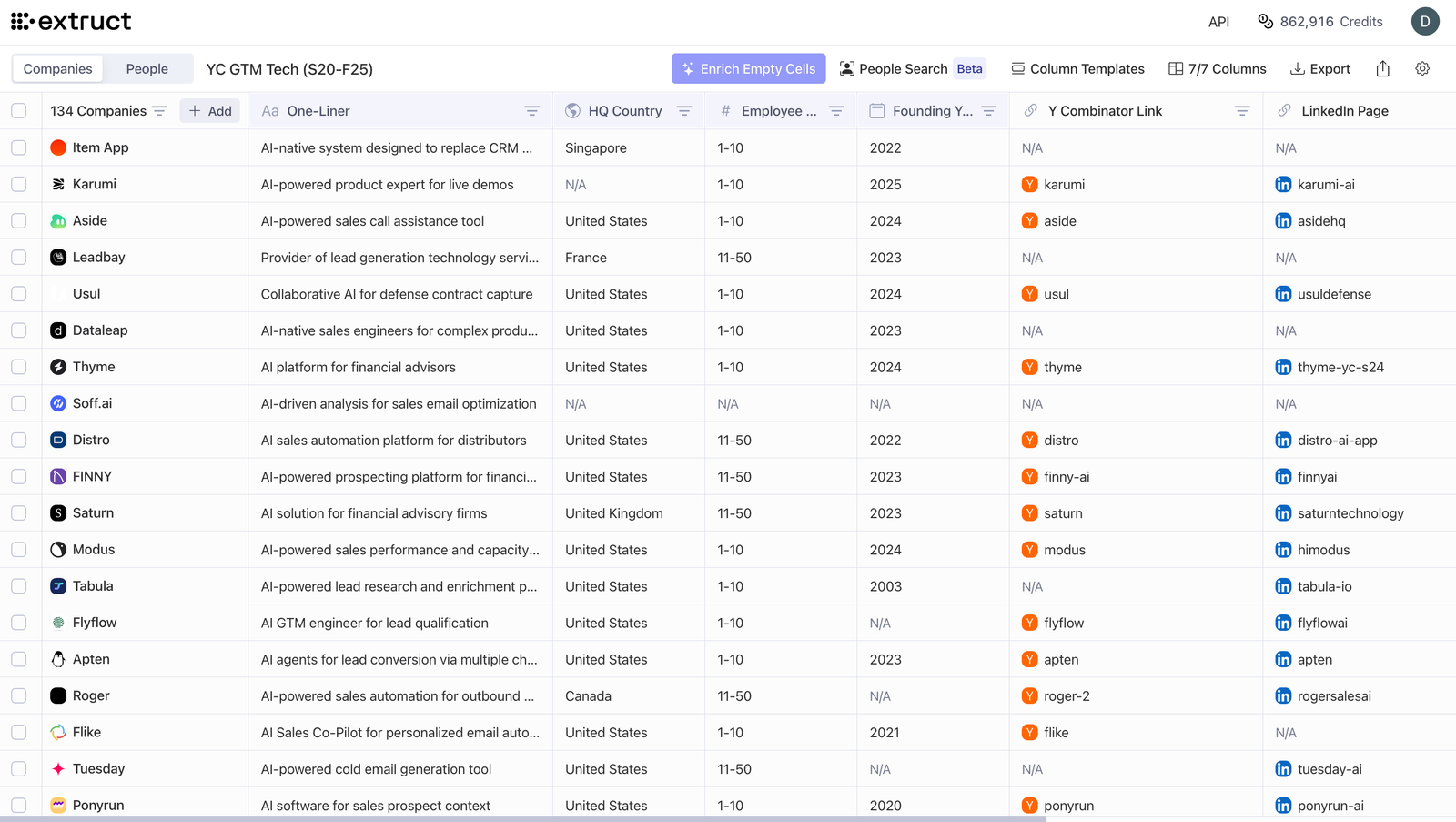

We analyzed 135 Y Combinator companies in GTM-tech, from S20 to F25. 100% of them use AI. That's table stakes now. But beyond the buzzword — what are they actually building?

The shift is clear: from tools that help humans → to agents that replace tasks entirely.

Here's a deep dive into what's actually happening in each category.

1. AI SDRs & Lead Gen Agents

The most crowded space. And the most volatile. The premise is simple: replace SDR headcount with AI that finds, qualifies, and reaches out 24/7.

2023 was peak hype. 2024 got cold as copy quality dropped and signals got commoditized. But in 2025, AI SDRs are becoming useful again with a changed pitch. It's no longer "give us your website and we'll fill your calendar." Now it's: handle the non-quota deals, write well-researched copy, and take your best rep's playbook to scale it across the org.

My take on AI SDRs

I don't think the concept is dead, but initial expectations didn't match reality. The original AI SDR pitch was "black box + tooling." That doesn't work. Operators want control—on warm-up inboxes, sequencers, list building (the fun part), and enrichment.

I believe inbound SDRs provide less value than outbound SDRs, and their job is more automatable. Inbound will likely get replaced by AI or absorbed into hybrid models, while outbound SDRs are here to stay. The only way to break through AI noise is with people, execution, and message.

AI SDRs can work, but only if you treat them like a new hire:

- Two weeks of intensive training

- Daily auditing for the first 60 days

- Continuous optimization based on response quality

- Deep data integration

The players: Fuse (W25), Throxy (X25), Orange Slice (S25), Apten (S24), Roger (S24), AiSDR (S23), Arcimus (S23), Venta AI (S23), Fiber AI (S23), Coldreach (W23), Bluebirds (W23), Kular AI (W22), Artisan (W24), Birdie (S21).

2. Outreach Automation (Human-in-the-Loop)

Different from fully autonomous AI SDRs, this category focuses on the "co-pilot" zone where operators maintain control. AI drafts the emails, humans approve them. It's less risky and easier to sell to teams not ready to hand over the keys.

The players: OpenFunnel (F24), Terrakotta (W24), Persana AI (W23), Flike (W22), Super Send (W22).

3. AI-Native CRMs

The thesis here is that Salesforce was built for managers who want reports, while AI-native CRMs are built for reps who hate data entry.

My take

Everyone asks if Salesforce becomes redundant. I still think they're wrong. When you replace a CRM, you're replacing a process—years of workflows, integrations, and institutional muscle memory. However, for businesses that are AI-native from day one, there's no switching cost.

This splits the market into two:

-

AI layers on incumbent CRMs: Automation and sync on top of Salesforce/HubSpot.

-

Full CRM replacements: Built for AI-native companies.

- Octolane AI (W24) is "the world's first self-driving CRM."

- Ergo (W25) watches communications and auto-executes revenue tasks.

- Item App (F25) lets you ask "find me leads in X industry" and executes it.

- Other players: Twenty (S23), Relate (S22), Paloma (S25), Paragon AI (S22).

The companies that nail "zero-input CRM" will own the stack.

4. Vertical GTM Tools

While horizontal tools dominate, some founders are betting on going deep in a niche. The trade-off is a smaller TAM, but a stickier product and faster sales cycles.

The players:

- Financial services: Thyme, FINNY, Saturn (S24), Blume Benefits (W24)

- Car washes: FlexWash (W23), Rinsed (W21)

- Government/defense: SalesPatriot (W25), Usul (S24)

- Auto: Flai (S25)

- Home services: Cactus (X25)

- Other: Distro (S24), Albiware (S22), gaiia (W21), Vantel (W25)

5. Live Call Assistants

AI that helps during the call, not just after. This includes real-time Q&A, coaching nudges, and surfacing context when you need it.

The players: Aside (F25), Nomi (X25), Echo (W23), Trellus (W22).

6. Demo Agents & Interactive Demos

Two approaches exist here: AI that runs demos autonomously (no human needed), and platforms that let prospects self-serve interactive demos.

Hot take: I'm still skeptical of AI avatars doing demos. Do buyers actually want that? It feels like it optimizes for the seller's convenience, not the buyer's experience. The self-serve interactive demo approach seems more aligned with buyer preference.

The players: Karumi (F25), Demospace (W23), Demo Gorilla (W22), Storylane (S21), Coast (S21), Rivia.AI (S21), Navattic (W21).

7. Sales Training & Coaching

Training is expensive and inconsistent. AI fixes both. Startups are using AI for simulation (roleplays as tough buyers) and analysis (reviewing real calls to find patterns).

The players: Candytrail (S25), Hyperbound (S23), Letter AI (S23), Hindsight (W23), SilkChart (S22).

8. RFPs, Proposals & Quoting

Responding to RFPs and creating custom pricing is a massive time sink. This category automates the back-office sales work.

The players: Mercura (W25), Outlit (W25), Veles (W24), Inventive AI (S23).

9. Relationship Intelligence & Warm Intros

"Who you know" still matters. These tools map networks and surface warm paths to prospects.

The players: Pally (S25), Centralize (W24), PartnerHQ (W24).

10. Sales Infrastructure

The picks and shovels. Not sexy, but necessary.

The players: Surge (F24), Cargo (S23), Lightmeter (W22), PromptLoop AI (W22), PowerRouter (W21), Salesform (S20).

My Take: Is AI sales tech cooling off?

I checked the data. No.

- Pre-ChatGPT (S20-S22): 55 startups.

- Post-ChatGPT (W23-X25): 75 startups.

Per batch, we saw 24 in 2023, 28 in 2024, and 23 so far in 2025. The interest remains high.

Conclusion: What's actually getting automated

Looking at these 135 companies, almost every part of a salesperson's job is being addressed.

- SDRs: Most directly impacted. Tools from AiSDR to Throxy are automating high-volume top-of-funnel work. Inbound SDRs will likely get replaced first, while outbound stays human.

- Account Executives: Not replaced, but supercharged. Assistants handle admin, scheduling, and data entry. AEs can manage larger pipelines and focus on relationships.

- Sales Managers: AI handles routine coaching and deal analysis (e.g., Hindsight), allowing managers to shift to strategy and culture.

- Sales Ops: Tools like Ergo and DryMerge reduce manual CRM maintenance, shifting the role toward process design.

The trend is accelerating: newer startups are more ambitious about end-to-end automation, yet a lot of AI GTM products are solving the last mile before fixing the foundation.