The "ZoomInfo for X" Thesis

Most GTM strategy is built for selling software to software companies. But the real economy runs on physical events. We explore vertical GTM data providers tailored for the real economy.

Most GTM strategy and fancy LinkedIn content is built for selling software to software companies. It relies on digital exhaust, such as website visits, ad clicks, and tech stack detection.

But if you've ever engaged with vertical SaaS, selling to the real economy, that data is almost useless. The real economy (construction, logistics, healthcare, government) runs on physical events.

And the company that has only 2 employees on LinkedIn might, in reality, have just broken ground on a $50M commercial complex.

In this issue, we will explore vertical GTM data providers tailored for the real economy. We will explore the data value chain of the companies and what the future holds for the market as a whole.

Our Takeaways

1. The vertical GTM data market is real but fragmented

We tracked 34 players across 11 verticals, totaling ~$34M in funding. Yet only one company, Definitive Healthcare, is publicly traded, and it trades at a steep discount to ZoomInfo (1.5x vs 3.5x EV/Revenue). Vertical SaaS always has a capped TAM problem, plus customer concentration risk - a handful of enterprise buyers can represent outsized revenue. The same scales down to vendors helping vertical SaaS.

2. Construction and Government are the hottest verticals

Our data shows the highest concentration of companies and recent funding in these two sectors. Government data demand surged post-2023 due to defense budget increases and infrastructure spending. Construction benefits from permit data being public and high-value.

3. AI hasn't disrupted data collection

Not many vertical providers emerged post-ChatGPT compared to the number of agents. Most innovation is happening in AI-powered analysis on top of existing databases, not in data collection itself.

4. The marketplace route is interesting and creates a defensible position in terms of moat

Companies like ConstructConnect and ThomasNet prove that B2B marketplaces can capture buying behavior organically, no scraping, no licensing, no verification calls. And you can monetize the same asset twice: transactions + data.

5. Data building blocks are the future for vertical agents

Growth-stage AI vertical companies are hunting data owners. Harvey partnered with LexisNexis; Clio acquired vLex. Expect consolidation among data providers.

The Market Context

Let's start with public data. There is one publicly traded company that provides GTM intelligence for the medical industry - Definitive Healthcare (DH).

ZoomInfo generated in 2025E $1.240B (+2.0% YoY) and trading with a 3.5x EV/Revenue multiplier.

Definitive Healthcare made in 2025E $240M (-5.0% YoY) and trading at 1.5x.

DH is not solely sales intelligence; roughly 40% of it is GTM-based revenue, totaling ~$96M.

ZoomInfo tells you who works at a hospital, but DH tells you which surgical workflows are growing, which device categories are gaining share, and which IDN affiliations influence purchasing.

So let's check other industries in the private sector.

The Landscape by Vertical

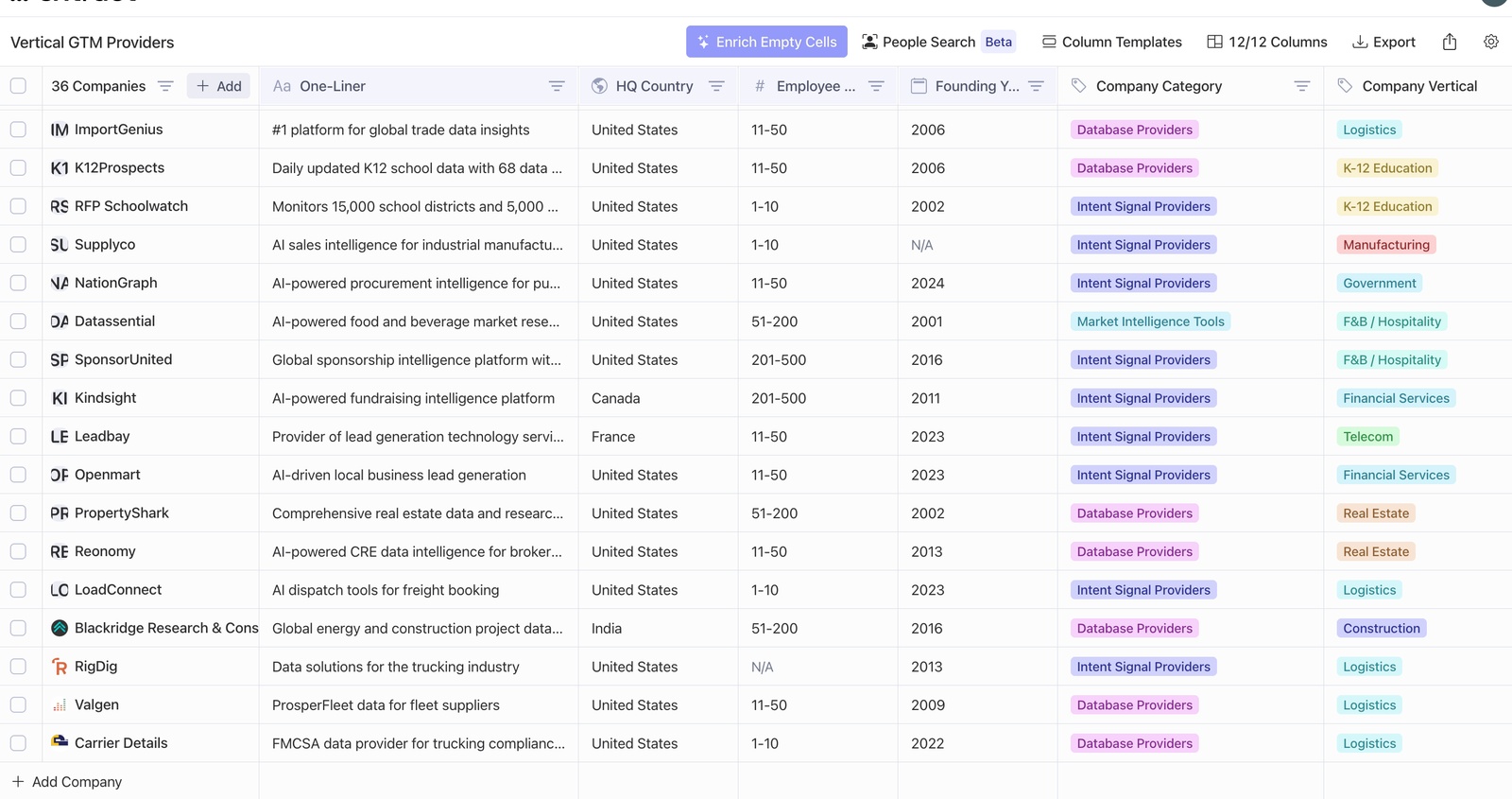

Grab the full table CSV here.

We analyzed companies across sectors based on their GTM and tried to understand how differences in positioning translate into the number of findings and connections for each competitor.

Construction

- ConstructConnect ($120M rev, $20M raised)

- Building Radar ($38M rev, $13M raised, Series A)

- Construction Monitor ($8M rev)

- Shovels ($8M raised, Seed)

- Mercator.ai ($4.5M raised, Seed)

- Metroc (Seed)

- TheScribe AI

Signal: Permits, project stages, rezoning filings

Government

- GovTribe ($1M rev, acquired)

- Govly ($2.1M rev, $13M raised, Series A)

- GovSignals ($5.5M raised, Seed)

- HigherGov

- Pursuit

- GovScout

- NationGraph ($4.5M raised, Seed)

- Datapolitics

Signal: RFP releases, grant awards, budget discussions, meeting minutes

F&B / Hospitality

- Datassential ($38M rev, Growth stage)

- SponsorUnited ($40M raised, Series A)

- Openmart ($2.3M raised, Seed)

- Leadbay

Signal: Menu intelligence, sponsorship deal flow, local business ownership, decision-maker contacts

Healthcare

- Definitive Healthcare ($240M rev, public)

- AcuityMD ($84M raised, Series B)

- Alpha Sophia ($1.4M rev, $1M raised)

- Ampliz ($29M rev)

Signal: Procedure volumes, claims data, affiliation hierarchies

Real Estate

- Reonomy ($2.7M rev, $128M raised)

- PropertyShark ($5M rev)

- PropStream ($2.5B valuation post-acquisition)

Signal: Property records, ownership data, sales comps, likely-to-sell predictions

Logistics

- ImportGenius ($14M rev)

- CarrierSource

- RigDig

- Valgen

- Carrier Details

Signal: Bills of lading, manifests, and carrier reviews

Legal

- Premonition Analytics ($5M raised, Seed)

Signal: Court records, attorney win rates

Energy

- New Project Media ($5M rev, Seed)

- Blackridge Research & Consulting

Signal: Original journalism from locally-based reporters

Education

- K12Prospects (<$5M rev)

- RFP Schoolwatch

Signal: School district contacts, education RFPs

Other

The Data Value Chain

There are three main ways to obtain data:

Aggregation of public sources. Collect from fragmented public sources and layer API/UI on top. Most vertical data players are working from the same inputs (county permit records, SAM.gov, public project data, federal funding, policy data, government bid data, school district data, etc). Differentiation often comes from breadth (long-tail coverage) rather than exclusivity.

Primary research. Definitive Healthcare's research teams make thousands of verification calls annually. New Project Media (energy) has 15+ locally-based reporters generating original journalism that can't be scraped. PitchBook built a strong moat the same way.

Licensed third-party data. Claims data, property records, and credit data from other vendors (healthcare procedure data, HCP profiles, and healthcare identity data). It can be expensive, but it is available to anyone willing to pay. Read that as a combo of 1 and 2.

People search becomes critical here because it requires a proper setup to find the real owner of the building or the restaurant manager, not just the default dial number.

It's actually a headache. I was once involved in building a prospecting list for the restaurant industry and discovered that it's not an easy task to find the actual owner, not just the number listed on Google Maps or the restaurant's main line (that's where most GTM scraping tools typically stop).

The data lives in public registers, in deep exploration of Instagram pages to see which restaurants have tagged, in mapping holding company dynamics, etc. It's a cumbersome project.

The Marketplace Route

Another path for vertical data providers is scaling into B2B marketplaces.

Many SMBs don't have websites, so you can aggregate them directly on your platform rather than just selling data about them. Marketplaces capture buying behavior organically. And you can monetize the same asset twice: transactions + data.

ThomasNet started in 1898 as an industrial supplier directory. Now it generates petabytes of data from sourcing activity that sells to third parties.

ConstructConnect operates with over 825,000 active projects and a network of 100,000+ subcontractors. They've evolved from a pure marketplace to a hybrid platform that sells both access and intelligence.

CarrierSource started as a freight load board. Now they also provide shipper-intent signals to carriers.

Post-2023 Entrants

Surprisingly, not many vertical providers emerged post-ChatGPT, especially given the number of agents.

- NationGraph (2024) / Government ($4.5M Seed)

- GovScout (2025) / Government

- Pursuit (2023) / Government

- GovSignals (2023) / Government ($5.5M Seed)

- TheScribe AI (2023) / Construction, Government

- Leadbay (2023) / SMB

- Openmart (2023) / SMB ($2.75M Seed)

How I read this:

Demand for government data surged due to increased defense budgets. Companies selling into this sector need intelligence on where dollars are going before RFPs drop.

SMB is the space where many agents are drowning; hence, new entrants are trying to solve local business data problems.

But honestly, not much innovation can be attributed to applying AI for data collection itself.

GTM engineers don't have the resources or capacity to aggregate 200 different government sources on their own. It's a messy world of data alignment out there.

So I'm pretty bullish on that space in Y2026:

- You're doing the boring part. Claude Code can probably build an ETL pipeline, but you'd need to keep a close eye on it. I feel most people will be okay with outsourcing that to vibe-coding.

- Growth-stage vertical companies are hunting data owners. Example: Harvey partnered with LexisNexis; Clio acquired vLex.

- Bullish on "data building blocks" tools that help providers construct better databases.

- Expects consolidation among data providers.

Subscribe to our newsletter

Get weekly intelligence drops with unique data points and market insights you won't find elsewhere.

Danny Chepenko

Danny Chepenko