The State of PLG in 2025: What the Data Actually Shows

We analyzed 474 Series A startups to understand how product-led growth actually plays out in 2025. The data reveals a more nuanced picture than the PLG-versus-sales debates suggest.

If you've been following SaaS over the past few years, you've heard the narrative: product-led growth is eating the world. Self-serve is the future. The days of sales-led motions are numbered.

But when you look at data from 2025, the story is more nuanced — and more useful.

Why this moment matters

- Series A bars have risen since 2021. Many founders report a median ~$3M ARR to clear a 2025 Series A vs. ~$1.3M in 2021–22. That reset pushes teams toward capital-efficient GTM.

- The GTM "pendulum" is real. Companies like Equals and Superhuman have openly swung between sales-led and self-serve before settling into a hybrid. The binary "PLG vs. Sales" framing is increasingly outdated.

- We now see where PLG actually fits. Developer tools and cloud infrastructure use PLG heavily; regulated categories (healthcare, certain fintech) remain predominantly sales-led.

What "PLG" really means in 2025

PLG means users can start using the product without talking to sales. It does not mean "free." In fact, most PLG companies charge from day one — they remove friction, not price. Stripe, Vercel, and Linear exemplify this: instant start, quick time-to-value, and pricing that begins early.

What the 2025 dataset says

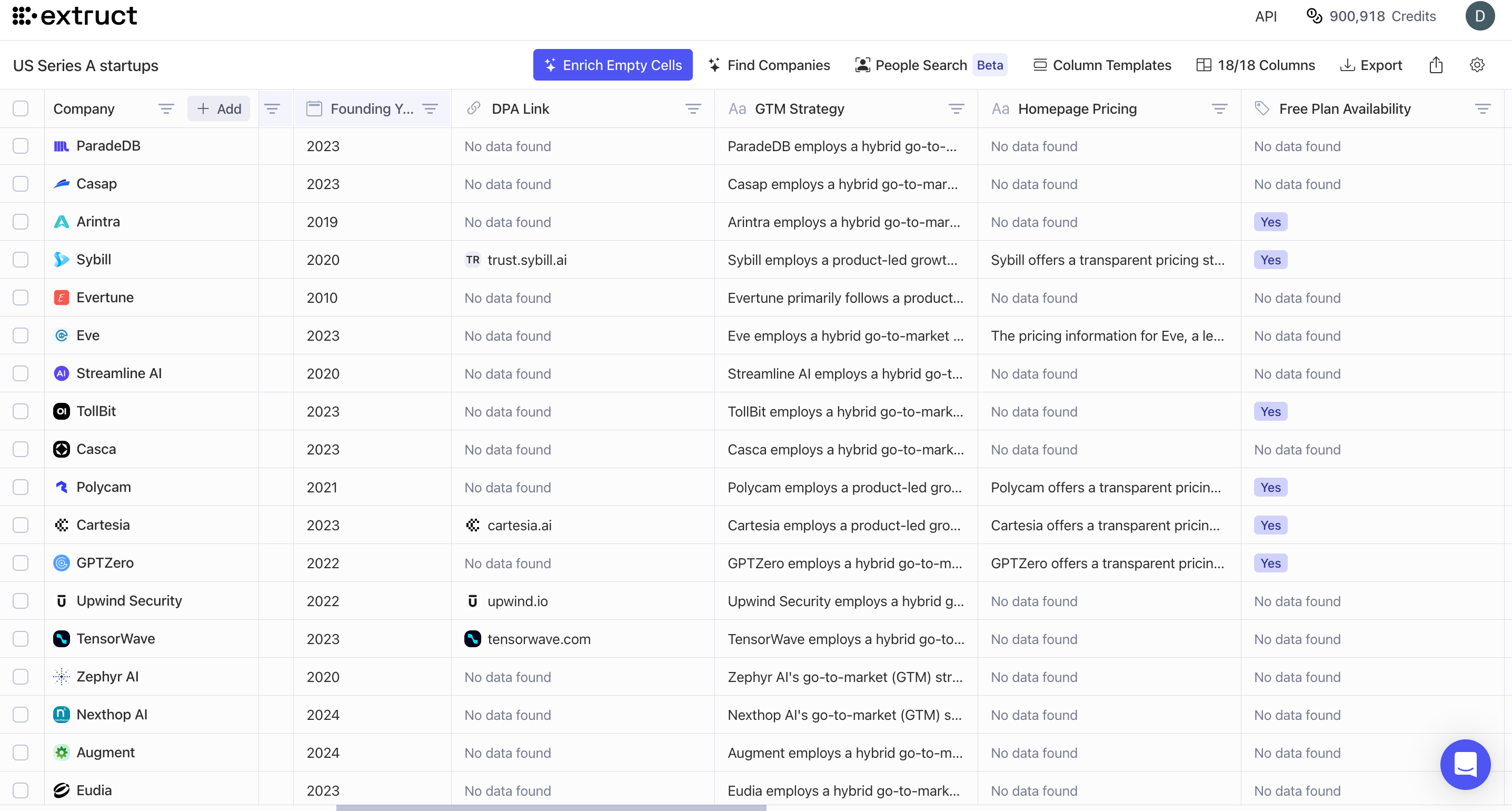

From a scan of 474 Series A startups in 2025:

- 39% enable PLG/self-serve.

- 25% offer a free tier.

- In DevTools (n=122): 50% are PLG, 47% self-serve, 34% offer a free plan.

Interpretation: PLG is meaningful but not universal, and self-serve ≠ freemium. Many winning PLG motions charge from day one while minimizing activation friction.

What we're seeing in the field (recent newsletters & playbooks)

- Superhuman's move: Human-led onboarding → productized, self-serve. A detailed First Round Review playbook outlines when to keep high-touch (to learn and increase LTV) and when to shift to self-serve (to scale acquisition) — reinforcing the pendulum pattern.

- Equals' story: "Self-serve strikes back." Equals paused self-serve, doubled down on sales to learn, then returned to self-serve after shipping a clearer value path (clean Stripe data → ARR reporting → dashboards). The insight: tighten the first mile before removing friction.

- Post-funding SaaS spend spikes: Data Driven VC summarized Cledara's analysis showing ~20% average increase in software spend within six months of new funding, +2–3 tools added, and a 13% rise in subscriptions. More than half of finance leaders regret some purchases post-round. Translation: funding lifts adoption, but uncontrolled tool sprawl can erode efficiency — a key watchout for PLG-heavy stacks.

Where PLG works best

- Products with immediate, demonstrable value (usage is the demo).

- Buyers who are also users (or sit adjacent to them).

- Clear time-to-value within the first session or day.

- Strong bottoms-up discovery (search, community, dev relations) and easy integration pathways.

Where PLG struggles: complex implementations, multiple stakeholders, heavy compliance, or categories where proof requires people, data migrations, or long config cycles.

The GTM pendulum: how to use it deliberately

- Early stage: Bias to human-led onboarding to learn and compress the feedback loop. Instrument the first-mile journey obsessively.

- Middle stage: Productize those learnings into guided self-serve flows, with optional assist. Keep "escape hatches" for sales where ACV, complexity, or security warrants it.

- Later stage: Adopt a portfolio approach — self-serve for low/medium complexity segments; sales-assisted for high-ACV, multi-threaded deals.

Signals you're ready to shift more self-serve

- Median time-to-value (TTV) < 30 minutes for core job-to-be-done.

- Activation-to-paid conversion stabilizes across cohorts (not just hero users).

- Support volume shifts from "how do I?" to "can it also …?"

Metrics that actually matter for PLG in 2025

- Activation rate to first value (and time-to-first-value)

- Activation → paid conversion by segment

- Payback period and marginal CAC (self-serve vs. assist vs. sales-led)

- Expansion revenue share and net revenue retention by cohort

- Unit economics of support/onboarding at scale (tickets per 100 signups; CSAT)

So, is 39% PLG "good" or "bad"?

Neither. It's a signal that PLG is powerful under specific conditions — not a universal default. The 61% that stayed sales-led aren't behind; many are in categories where human-led sales still wins on economics and risk.

What this means going forward

- For the 195 PLG-driven Series A companies, the next test is efficiency. Series B typically wants ~$10M ARR. That's 3–4x growth in 18–24 months with disciplined CAC, strong activation-to-paid, and durable expansion.

- Don't conflate self-serve with free. Most successful PLG motions charge early; they invest in first-mile clarity, not giveaways.

- Treat GTM as a system. Use high-touch to discover, then self-serve to scale — and keep a sales-assist lane where ACV/complexity justifies it.

- Control the software sprawl. Post-funding tool expansion is real; governance and ROI tracking protect efficiency as you scale PLG adoption.

If you're deciding whether PLG fits, start with two questions:

- Can a new user reach unmistakable value in minutes without human help?

- Is the economic buyer close enough to the user that bottoms-up adoption can credibly trigger purchase?

If both are "yes," design self-serve now. If not, run a human-led motion to learn quickly — then productize those learnings into self-serve when your first mile is truly ready.

Sources referenced: category dataset (474 Series A; PLG/self-serve/free rates); First Round Review on Superhuman onboarding; Equals' "Self-serve strikes back"; Data Driven VC summary of Cledara's post-funding SaaS spend analysis.

Drawing the line: Sales-led vs. Self-serve (vertical vs. horizontal)

Use this quick rubric to choose the dominant motion; add the other as an assist.

Vertical SaaS (regulated, workflow-heavy, bespoke ROI)

- Default: Sales-led with product assist

- Signals: Multi-stakeholder sign-off, data migrations, compliance reviews, integrations gating value

- Success metric focus: Win rate by segment, sales cycle length, sales efficiency, implementation NPS

Horizontal SaaS (broad audience, immediate utility, easy import/connect)

- Default: Self-serve with sales assist for larger ACV

- Signals: Time-to-first-value < 30 mins, user = buyer or adjacent, low-risk trial/proof via sample data

- Success metric focus: Activation→paid conversion, TTV, payback, expansion/NRR by cohort

SMB vs. Enterprise overlay

- SMB: Bias to self-serve; sales assist only for bundles and annual commits

- Enterprise: Land with self-serve where possible; expect security/procurement to trigger sales-led

Pricing and packaging tells

- Clear, public pricing + month-to-month: favors self-serve

- Custom quotes, security questionnaires, SSO/SAML as gate: favors sales-led

Onboarding reality check

- If you must "teach" before value, start sales-led and productize learnings

- If usage is the demo, start self-serve and add optional human help where lift is justified

Practical note: Many top-performing companies run both in parallel — self-serve to widen the funnel and learn quickly; targeted sales to unlock high-ACV, multi-threaded accounts.

About Extruct AI

Extruct AI is an AI-native company and people data provider. The platform transforms complex queries into precise lists of high-fit companies while uncovering unique data points that traditional platforms such as ZoomInfo or Apollo often miss.

Most existing GTM tools rely on rigid filters and break down when exploring nuanced industry taxonomies and industry-specific data points. As well as targeting companies in less digitalized sectors.

Dimitri Persiianov

Dimitri Persiianov